On one hand, accommodative economic policy will keep an opportunity price of holding gold low. And should large degrees of inflation getting entrenched, gold’s focus since the a great hedge up against a decrease in to find power would probably end up being improved. As well, large rising prices manage ultimately trigger firming monetary policy, lowering gold’s desire when compared with other, yield-influence property.

Gold bullion is traditionally seen as an agenda while in the monetary, monetary as well wjpartners.com.au proceed the link as personal uncertainty. Whenever committing to silver in an effort to spread exposure, the best if you consider can cost you, shelter and you may ease. BullionVault addresses these issues and make to purchase gold lesser, safe and simpler.

Actual Silver

- The brand new gold madness will come since the segments around the world always stress more than Trump’s tariffs, which happen to be generally anticipated to increase costs for consumers.

- Over the past half a century, silver prices has altered notably, influenced by of several economic and you may governmental events.

- He’s continuously within the a discovering procedure and you can provides themselves inspired by revealing their acquired education.

- Even after steady rising prices since the 1988, silver has registered a bad get back inside the 18 schedule many years, along with 2021 and you may 2022 — ages having such high inflation.

It is uncommon, since you explain, that it provides rallied therefore firmly today whenever one thing look generally Ok, but . Precious jewelry request, and therefore constitutes from the 40percent of global gold usage, get decline on account of checklist-large rates. Asia, the country’s 2nd-prominent nation inside gold precious jewelry demand, is going as a result of a temporary smooth patch inside the financial development.

Gold rate remains upwardly biased, yet the trend appears exhausted. The brand new Relative Electricity Directory (RSI) signifies that buyers are dropping soil on the RSI’s leaving of overbought territory beginning the entranceway to possess a great retracement inside Bullion costs. Players type and you may obvious decks inside the typical solitaire manner, looking to get large and you may effortlessly over game in order to outperform competitors. Victory utilizes quick thinking and you can productive card management.

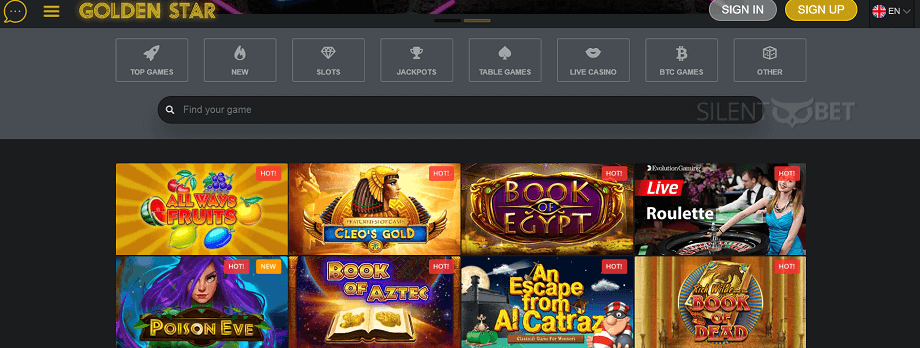

RTP is key contour to own ports, doing work reverse our home boundary and you may demonstrating the possibility rewards to help you players. The brand new red-colored steel usually does really whenever almost every other monetary property is at a negative balance, and particularly when people are dropping believe inside banking companies and cash. One element you to definitely will continue to generate Gold Rally one of the most popular progressive jackpots on the net is the brand new payment. As you do need to bet to 16 revolves to help you shelter all your paylines, as previously mentioned, this can lead to a highly unbelievable commission. Is in reality one of the better-investing harbors, having a verified commission part of over 90percent. To winnings the new jackpot, you would like all nine of your own Spread out signs on the grid.

Simple tips to Enjoy Silver Rally Position On the internet

The fresh silver market has defied standard thus far inside 2024, rallying in the face of the newest Federal Put aside’s large for longer monetary policy position. When rising prices-adjusted rates of interest are highest, the possibility price of holding low-yielding assets such as metals develops, prompting people to hold from to the orders if not offer. As a result, demand for gold will surge while in the recessions, financial crises, and you can inflation frightens, while it wanes during the attacks from lower monetary worry and a good roaring stock market. To the along with front side, silver become February aided from the good Chinese consult within the Spring Event.

Unlike most other products, the purchase price doesn’t only hinge for the industrial request (and this, in the silver’s case, is usually for jewelry). Investors and look at silver because the a good money, one which provides endured while the old Egyptian pharaohs. Costs rise whenever buyers build nervous about the stock exchange, geopolitical imbalance and you can rising prices. Concerns about rising prices can be publish silver prices hiking if buyers pick you to report currencies, backed by little from tangible value, will lose to shop for energy. Despite ascending productivity catching all of the statements so far so it year, interest rates are still structurally low.

Which milestone represents solid trader rely on powered by several outside points. Constant tries to come to agents to the companies by cellular telephone and you will current email address hit a brick wall. But Bank of America spokesman Expenses Halldin said he’s heard accounts out of financial group from users arriving to exchange the Trump Cash for cash, but the bank consistently turns them down. Top economists say a recession is more likely than to begin with requested. With the fresh tariffs set to be revealed on the April 2, traders and economists are growing a lot more concerned about an economic lag or recession. Almost every other research revealed that Present Household Conversion plunged, and also the School from Michigan (UoM) Individual Belief Finally discovering to own March deteriorated then.

It was for example apparent in the highest rising cost of living of your own 1970s plus the early 2000s if You.S. dollar poor. Gold’s condition while the a real, widely accepted investment has made it an excellent looked for-once secure haven through the episodes from monetary otherwise geopolitical suspicion. Certain collection optimization knowledge recommend that getting a small part of a financial investment profile inside gold can be increase exposure-adjusted efficiency.

Unrelenting individual inflation, minimal readily available solution financing and you can home-based political suspicion within the presidential elections this past year drove Turkey’s need for the brand new reddish material. Poland’s central bank try next-largest web individual out of silver, snapping upwards 130 numerous bullion inside the 2023. Solid physical interest in gold is additionally supported from the the attention as the a safe-retreat investment in the midst of geopolitical uncertainties. Even as we talked about in past times, the overall game looks easy when you’re concealing their complexity, and now we can provide you with a good example to help you teach exactly that. For many who lookup through to Gold Rally you’ll figure it’s a good three reels position games, but if you most feel it you’ll come across these reels twist inside another fashion, to make functions obtaining the nine reel program at the foot. You’ll strike gold if you make the brand new max 16 wager and you will refill all the room to the panel with the newest fantastic measure symbols.

In only six-weeks anywhere between February and you will April, these types of investors propelled gold costs right up from the eight hundred, otherwise 23percent—an amazing rise to the purple steel. Subsequently, the pastime provides quieted, but We have forecast their return, expecting them to push silver to truly staggering membership. Fresh off the month-much time Chinese Lunar New-year escape, such traders is reentering industry—just as silver was already heating without them. Immediately after battling to own a lot of 2014, silver and gold have experienced certain respite before partners months as the Eurozone and you can emerging field concerns emerged once again.

Silver rally renders riches professionals thinking when the pricing is still proper

Early Saturday, gold futures struck an alternative list price of 3,177 per ounce, ahead of losing back a little. But they are nonetheless right up more 18percent from the beginning of the season — as the S&P 500 is actually down over 4percent over the same period. Broadening gold allocations during the last 12 months have obviously resolved well to own traders.